- by New Deal democrat

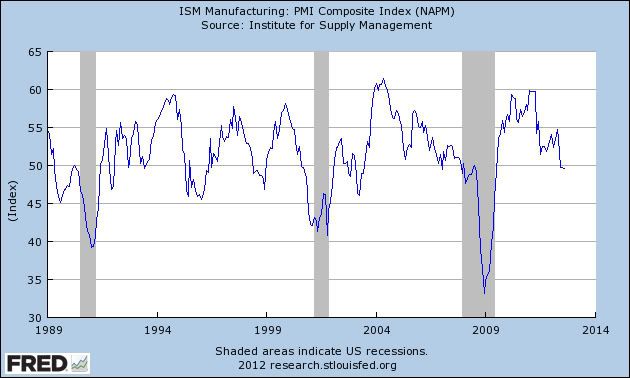

Reports on the economy from August started out with a contradictory bang yesterday, as the ISM manufacturing index showed a tiny contraction for the third month in a row, while motor vehicle sales set a post-recession record. The contrast between what is potentially a new global recession vs. improvement in the domestic US economy seems stark.

To repeat a point I've made many times before, based on research conducted by Prof. Edaward Leamer, typically the economy is led (by well over a year) by housing. It usually peaks 5 or 6 quarters before a recession begins. After housing turns, next comes durable goods, especially motor vehicles, which peak 6 to 12 months before the recession begins.

That was certainly the case going into the 2007-09 great recession, but the recovery was not led by housing, which bottomed only a few months before the end of the recession, and went more or less sideways for going on 2 years thereafter. Instead, the recovery was led by manufacturing and exports, which boomed. The ISM manufacturing index improved to readings that with the exception of one year, it had not seen since the 1990s.

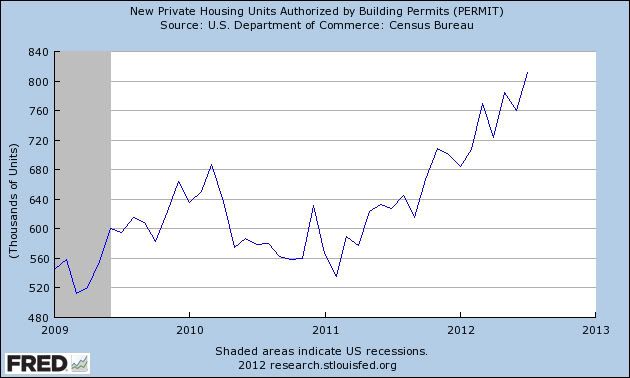

This year the situation has reversed. First of all, here's the most recent update on housing permits:

I focus on housing permits because what is crucial for the economy is the amount of new housing stock, and secondarily home improvements, added to what exists. New houses employ construction workers, suppliers, landscapers, and after the housing is bought, appliances, furniture, window and door treatments, decks, patios, pools, trees, shrubs, and gardens are added over time. For the same reason, it's not so much the amount of permits themselves, but their improvement over time which is critical. The approximately 200,000 additional permits added over the last year in past experience has typically been associated with very strong GDP growth on the order of 4%.

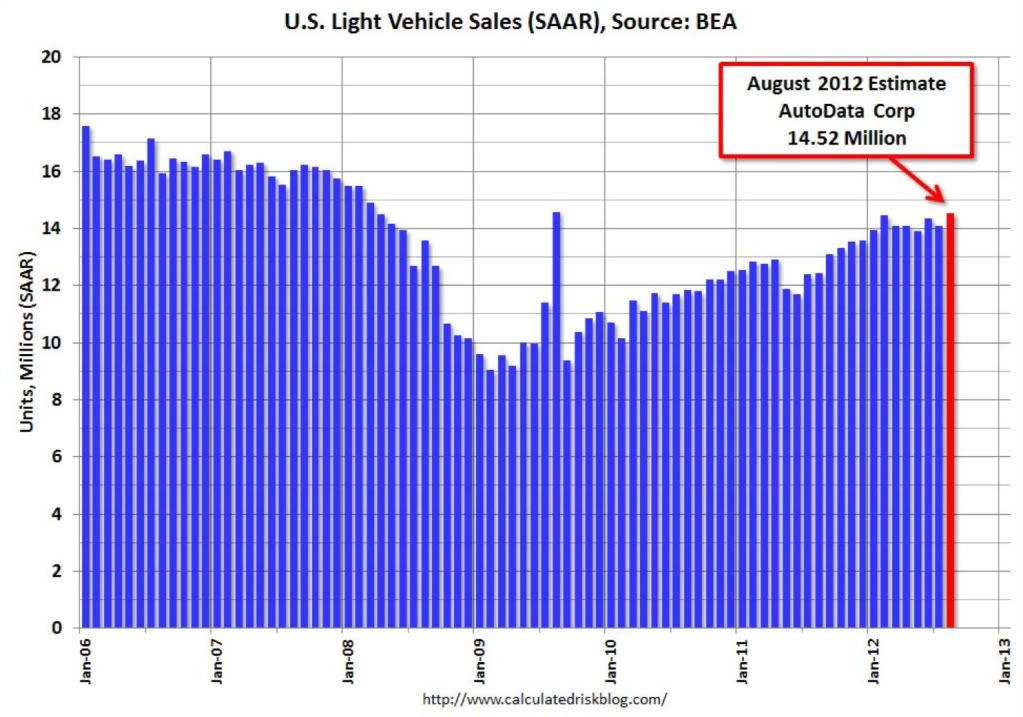

Similarly, motor vehicle sales typically peak more than 2 quarters before the onset of a recession. Here's the data (averaged quarterly) from 1976 to 1992 (note sales never totally recovered following the 1980 recession):

And here it is from 1999 to through the second quarter of this year:

Not only were August sales the strongest in over 4 years, but the last 3 months as an average set a new post-recession record as well:

(courtesy Calculated Risk)

In short, if Leamer's business cycle order holds true now, we're nowhere near the onset of a new recession.

But if the housing recovery is finally underway, the export-led manufacturing boom which brought us out the the recession in 2009 has completely stalled, with three months in a row with readings slightly under 50, meaning ever so slight contraction. But the record here is more mixed. Recessions have started without the ISM manufacturing index slipping below 50, but more frequently the index has been well below 50 for a number of months before the recession began. In the last 25 years alone, the ISM index has dipped below 50 nine times, 4 of those times substantially, without a recession ensuing:

Similarly, while of the 13 times this index dropped below 50 from 1948 to 1983, a rescession followed 8 times, while 5 times it did not.

Manufacturing appears to be reacting to the global slowdown or contraction. Meanwhile, the US consumer is confident enought to be buying new houses and cars. In this tug of war, my bet is on the indefagitable American consumer. In that regard, August real retail sales, PCEs, and final business sales will tell us which side is stronger for now.

Source: http://bonddad.blogspot.com/2012/09/a-study-in-contrasts-housing-cars-and.html

toy story 4 toy story 4 steam kristin chenoweth Robert Blake BLK Water ESPYs

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.